Retirement in Your 30s? The FIRE Movement Explained

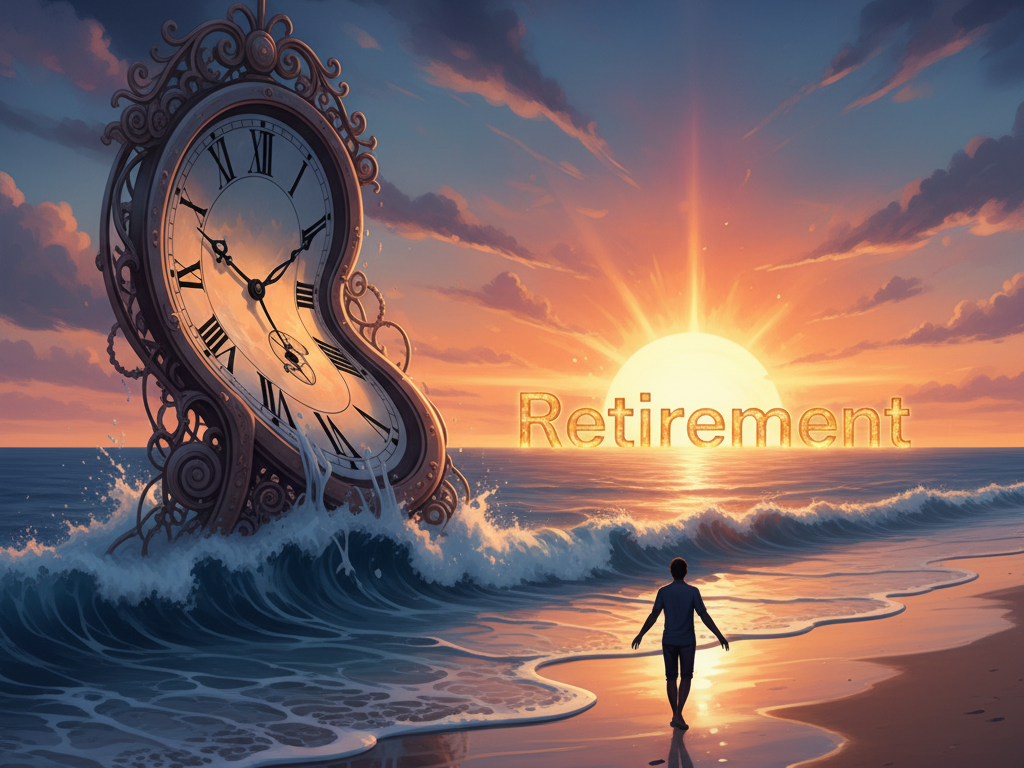

When most of us hear the word Retirement, we think of it as a far-off milestone. It’s usually tied to an age — 60, 65, or maybe even later. You work for decades, hopefully save enough, and finally, in your golden years, you get to relax. That’s the traditional picture. But lately, more and more people are asking: Does it really have to take that long?

Enter the FIRE movement — short for Financial Independence, Retire Early. This growing community believes that this isn’t about hitting a certain birthday; it’s about reaching financial independence as soon as possible. Some people are stepping away from full-time jobs in their 30s and 40s, decades earlier than society expects. For many, that feels almost impossible. But once you break it down, you realize it’s not magic. It’s discipline, strategy, and a reimagining of what this actually means.

Why Early Retirement Has Become So Popular

Think about it: the traditional system asks people to trade the best years of their lives for the hope of comfort later. You work 40 or more hours every week, juggle stress, and wait decades for Retirement. But the FIRE community flips that timeline on its head. Their philosophy is simple: save more now, spend less now, invest wisely, and build financial freedom faster.

The appeal isn’t just about quitting work. It’s about choice. Early Retirement doesn’t mean doing nothing — it means being free to decide how you spend your time. For some, that’s traveling the world. For others, it’s raising kids without financial stress, starting a passion project, or working on something meaningful without worrying about the paycheck.

In other words, FIRE challenges the idea that this has to be about age. Instead, it’s about freedom.

How the FIRE Strategy Works

So, how exactly do people in the FIRE movement manage to step into Retirement decades earlier? It comes down to three core strategies:

- Aggressive Saving

While the average savings rate in many countries hovers around 5–10%, FIRE followers save 50–70% of their income. That means cutting unnecessary expenses, avoiding debt, and being mindful of every purchase. Every dollar saved is a dollar closer to Retirement. - Smart Investing

Simply stuffing cash under a mattress won’t get you to early Retirement. FIRE enthusiasts rely on long-term investments, especially in low-cost index funds, rental properties, or side hustles that generate passive income. The idea is to make money work for you instead of always working for money. - Low-Cost Living

Living below your means is a cornerstone of FIRE. That doesn’t always mean living miserably — instead, it’s about designing a life that doesn’t require huge spending. Many adopt minimalist lifestyles, focusing on experiences instead of things. A lean lifestyle makes Retirement achievable much earlier.

When combined, these habits can create a snowball effect: savings grow, investments multiply, and before long, you’ve built enough wealth to cover your living costs indefinitely. That’s the gateway to Retirement.

The Lifestyle Shift That Makes It Work

Here’s where FIRE really changes lives: it transforms how you think about money. Instead of asking, “Can I afford this?” people in the FIRE community ask, “Is this worth delaying my Retirement for?” Suddenly, every expense feels different. That $500 gadget isn’t just a purchase — it might mean an extra month or two of work before you’re free.

This shift in perspective is powerful. It forces you to see money not as something to spend, but as a tool that buys time. And at its core, isn’t that what Retirement is all about? Buying back your time so you can live on your terms.

The Criticisms of Early Retirement

Of course, the FIRE lifestyle isn’t perfect, and not everyone is a fan. Some people argue that saving 70% of your income is too extreme, that life becomes all about deprivation. Others worry about the risks: what if the stock market dips? What if healthcare costs explode? Can your money really last for 50 years of Retirement?

These concerns are valid. FIRE isn’t for everyone, and even within the community, there are variations. Some pursue “Lean FIRE,” living frugally to retire on less, while others aim for “Fat FIRE,” saving enough to enjoy a more luxurious lifestyle in Retirement. The key takeaway is that FIRE isn’t one-size-fits-all — it’s a mindset shift. Even if you don’t aim for Retirement at 35, the habits can still get you financially free faster.

What Retirement Really Looks Like in FIRE

Here’s the truth: most people who achieve FIRE don’t actually stop working forever. Instead, they reinvent Retirement. Some start passion projects. Others build small businesses, freelance, or volunteer. The difference is, they’re not working because they have to — they’re working because they want to.

So maybe early Retirement doesn’t mean endless vacations (though it could). It means the freedom to create your own schedule and live life without depending on a paycheck. For many, that’s the real prize.

Can Early Retirement Work for You?

Now, let’s get practical. Can you really step into Retirement in your 30s or 40s? The answer depends on a few things:

- Your income level. Higher incomes make saving easier, but discipline matters more.

- Your lifestyle. The lower your expenses, the faster you can save.

- Your discipline with money. Avoiding lifestyle inflation (spending more as you earn more) is key.

Even if you don’t hit Retirement super-early, adopting FIRE habits will still set you up for a stronger financial future. Saving aggressively, investing wisely, and controlling expenses doesn’t just benefit early retirees — it benefits anyone who wants a comfortable life.

Why Retirement Shouldn’t Be About Age

The most important lesson of the FIRE movement is that Retirement isn’t tied to 65. It’s tied to independence. Whether you hit that in your 30s, 40s, or 50s doesn’t matter as much as realizing you have the power to decide. For some, the goal might not be to retire “early” but to retire “better” — with fewer money worries and more options.

That’s the beauty of this philosophy: it redefines what Retirement really means. It’s not the end of your productive years — it’s the beginning of your free ones.

Final Thoughts

At first glance, Retirement in your 30s sounds like a dream. And for most people, it may not be realistic to stop working that early. But that doesn’t make the FIRE movement any less valuable. It’s not about following someone else’s extreme blueprint; it’s about realizing that you don’t have to follow the traditional timeline if it doesn’t suit you.

Maybe your version of Retirement is cutting back to part-time work in your 40s. Maybe it’s building enough savings so you can take a year off without stress. Or maybe it’s sticking with the traditional path but doing so with more financial security.

The point is this: Retirement is no longer just an age — it’s a state of financial freedom. And once you start thinking that way, you open the door to possibilities you may have never imagined.

So ask yourself, not “When will I retire?” but “What do I want my Retirement to look like — and how soon can I make it happen?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a licensed financial planner before making decisions related to Retirement or investments.

More about us: